Sending money today is easier than it’s ever been, but that doesn’t mean every transfer is safe by default.

Between online scams, mistyped account details, and payment methods that sound similar but work very differently, it’s worth slowing down and understanding how to move money securely—especially when large amounts are involved.

That’s why secure money transfer requires more than tapping a button. It means knowing how each method works, double-checking the details, and choosing the option that fits both the amount and the urgency.

If you’ve ever wondered, how do I make sure my transfer is actually secure? This guide walks you through it step by step.

Why Safe Money Transfers Matter More Than Ever

It’s tempting to think a transfer is just a quick bank action, nothing more. But even one small mistake—one wrong number, one misunderstood payment method—can turn a simple transaction into something stressful.

Here’s why safe transfers matter:

- digital payments move fast—and aren’t always reversible

- scammers often pose as banks, employers, or government agencies to pressure people into sending money quickly.

- some transfers are final once sent

- different payment types have different levels of protection

- large transactions require extra verification

Whether you’re paying rent, sending money to family, or completing a business transaction, the more you understand, the safer you’ll be.

Step 1: Know Who You’re Paying (and Double-Check Before Sending)

It sounds simple, but this is where most mistakes start. If you’re paying someone new—an online seller, a contractor, even a friend’s new bank account—take a minute to verify the details.

A safe transfer checklist might include:

- Asking for written confirmation of the account details

- Verifying the person’s name matches the account. Minor spelling differences can signal a problem.

- Confirming timing and method of payment.

- Using secure bank channels (not links sent in emails or texts).

- For businesses or contractors, validate contact information independently.

And if you’re ever pressured to “send money immediately,” treat that as a warning sign. Scammers love urgency.

Step 2: Understand the Numbers You’re Entering

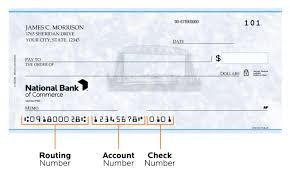

A surprising number of transfer issues happen simply because the info entered wasn’t fully understood. When you send money through a bank transfer, you’re generally asked for two key pieces of information: a routing number and an account number.

If you’ve ever wondered what is a routing number, it’s simply the number that identifies the bank or financial institution you’re sending money to. Think of it like the bank’s address, while the account number is the specific “apartment” within that address.

Routing numbers matter because:

- using the wrong one can send money to the wrong bank

- some banks have different routing numbers depending on the state or type of transfer

- wire transfers sometimes use a separate routing code for domestic and international transactions

Whenever you send money, confirm both numbers—routing and account—digit by digit to prevent days or weeks of trying to recover any misdirected funds.

Step 3: Choose the Right Transfer Method for the Situation

Different transfers offer different levels of speed, cost, and safety. Here’s a straightforward way to think about them:

Bank Transfers (ACH or Wire)

ACH is slow but good for regular payments, payroll, bills, and personal transfers.

Wire is standard for real estate transactions, large purchases, or time-sensitive payments. However, it is harder to reverse.

Mobile Payment Apps

Convenient, but only safe when you know and trust the recipient. These apps are a target for scammers because transfers move quickly, leaving little or no room to cancel.

Bank-Issued Payments

These include certified funds, cashier’s checks, and money orders.

They’re commonly used for larger transactions where guaranteed payment is important.

If you’re completing a high-value transfer—like buying a car or placing a down payment—many businesses will specifically request certified funds. Because they want assurance the money won’t bounce.

Note: Scammers can forge cashier’s checks, so always verify the check with the issuing bank before handing over goods or signing any paperwork.

Step 4: Use Multi-Layer Verification for Large or Important Transfers

Bigger transfers deserve extra caution. Before sending any large amount, consider:

- calling the bank to double-check recipient information

- confirming payment instructions through two separate channels

- verifying the business or person for legitimacy

- sending a small test transfer (if time allows)

This isn’t overprotectiveness. It’s practical. One verification call can prevent thousands of dollars from going into the wrong hands.

Step 5: Keep Records of Everything

Safe money transfers aren’t just about the moment you send the funds—they’re about having proof afterward.

Always save:

- screenshots of the original payment instructions

transfer confirmation numbers and reference IDs

receipts from your bank

any email/message threads tied to the transfer

Good recordkeeping can be critical if you later need to dispute a transaction, trace funds, or verify details for compliance or tax purposes.

Step 6: Know How to Avoid Common Scams

Unfortunately, scams around money transfers are more common than ever. The good news? Most follow predictable patterns.

Be cautious if:

- someone asks you to send money to “verify” an account

- a stranger requests payment through gift cards

- you’re asked to deposit a check and “return” part of the funds

- the seller refuses secure payment methods

- the message sounds urgent, threatening, or emotionally manipulative

Safe transfers happen when you trust the process—not the pressure.

Final Thoughts: Safe Money Transfers Come Down to Slow, Smart Decisions

Moving money isn’t complicated, but it does require care. Once you know how details like what is a routing number and where it fits into the process, or when to insist on certified funds, you start making safer decisions without even thinking about it.

Safe transfers have a simple formula:

- verify everything

- choose the right method

- take your time

- document the process

When you do that, your money moves securely—and you stay in control.